The big run-up in home prices may have cooled, but the 2023 conforming loan limit will be increased by 12% to $727,200 in most parts of the country

Federal regulators gave mortgage giants Fannie Mae and Freddie Mac the green light to back mortgages of up to $726,200 in most parts of the country next year, and loans exceeding $1 million will be fair game in more than 100 higher-cost counties and Census areas where it’s hard to find homes for less.

The big run-up in home prices may have cooled for now, but the Federal Housing Finance Agency announced a 12 percent increase in Fannie and Freddie’s 2023 conforming loan limit Tuesday, based on home price gains through Sept. 30.

Under a formula mandated by Congress, the conforming loan limit is tied to annual increases in FHFA’s seasonally adjusted, expanded-data House Price Index. That index, also released Tuesday, showed home prices posted 12.4 percent annual gains during the third quarter.

“House prices were flat for the third quarter but continued to remain above levels from a year ago,” said FHFA economist William Doerner in a statement. “The rate of U.S. house price growth has substantially decelerated. This deceleration is widespread with about one-third of all states and metropolitan statistical areas registering annual growth below 10 percent.”

The $79,000 increase in the conforming loan limit will come as a relief to big lenders like Rocket Mortgage and United Wholesale Mortgage, which had already started pricing loans of up to $715,000 as conforming in September.

It’s also good news for many borrowers looking to take out loans that exceed the 2022 conforming loan limit, which is currently $647,200 in most parts of the country.

Because Fannie and Freddie can’t buy or guarantee “jumbo” mortgages that exceed that limit, jumbo mortgages tend to have stricter underwriting and higher down payment requirements, and some borrowers may also pay higher rates than they would for conforming loans.

While the new limits don’t take effect until Jan. 1, lenders can treat loans that exceed the current limit as conforming by holding them on their books for a few weeks until the increase becomes official.

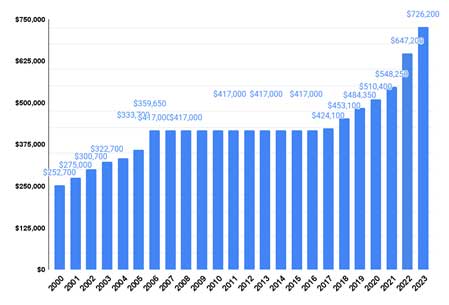

Baseline conforming loan limit, 2000-2023

The rapid run-up in home prices during the pandemic drove an 18 percent increase in the 2022 conforming loan limit, the biggest leap in records dating to 1970. While this year’s increase isn’t as large, it pushes the conforming loan limit in some higher-cost markets above $1 million for the first time.

In higher-cost markets, Fannie and Freddie are allowed to purchase bigger mortgages based on a multiple of the median home value, up to a ceiling that’s equal to 150 percent of the baseline conforming loan limit. For 2022, the new ceiling loan limit for one-unit properties in high-cost areas will be $1,089,300.

The conforming loan limit will exceed $1 million in 105 counties and Census areas concentrated in nine metro areas where home prices are far above the national average. The conforming limit will also be higher than the $726,200 baseline but less than $1 million in 58 counties nationwide.

Jennifer Branchini, a San Francisco Bay Area Realtor who is president of the California Association of Realtors, welcomed the increase in the conforming loan limit. Nearly one out of every four homes sold in California this year between $1.25 million and $2 million were purchased by first-time homebuyers, Branchini said in a statement.

Last year’s big increase in the conforming loan limit fueled a debate over housing affordability and competition in the mortgage industry. Having Fannie and Freddie help finance purchases of $1 million homes complicates the Biden administration’s goals to help more low-income Americans become homebuyers and address racial homeownership gaps.

The Housing Policy Council, a trade association representing mortgage lenders and servicers, issued a statement Tuesday warning that “Crossing the million-dollar threshold should cause Congress, the Biden Administration, and all other stakeholders to actively consider how our housing finance system operates today.”

Fannie and Freddie’s “excessively high loan limits” exacerbate affordability issues, and limit the role of private capital in housing finance, the group said.

To help the mortgage giants focus on helping first-time homebuyers, low-income borrowers and underserved communities, last month federal regulators ordered Fannie and Freddie to slash upfront fees on many purchase loans. To offset the impact of those fee reductions, Fannie and Freddie will be required to charge higher fees for most cash-out refis starting Feb. 1, 2023.

FHFA had previously ordered Fannie and Freddie to increase fees on high-balance loans and loans used to purchase second homes. Those fee increases took effect on April 1.

SOURCE: MATT CARTER / INMAN