Fierce Competition Continues in CA Housing Market

The California housing market is red hot as the year comes to an end. The state has already recovered all the sales it lost in the first half of the year as insatiable housing demand in recent months has propelled sales to levels not seen in the past 15 years. Sales of existing single-family homes surpassed the 500,000 benchmark for the first time since January 2009, while year-to-date sales through November exceeded last year’s level for the first time since March and recorded an increase of 1.3 percent from 2019.

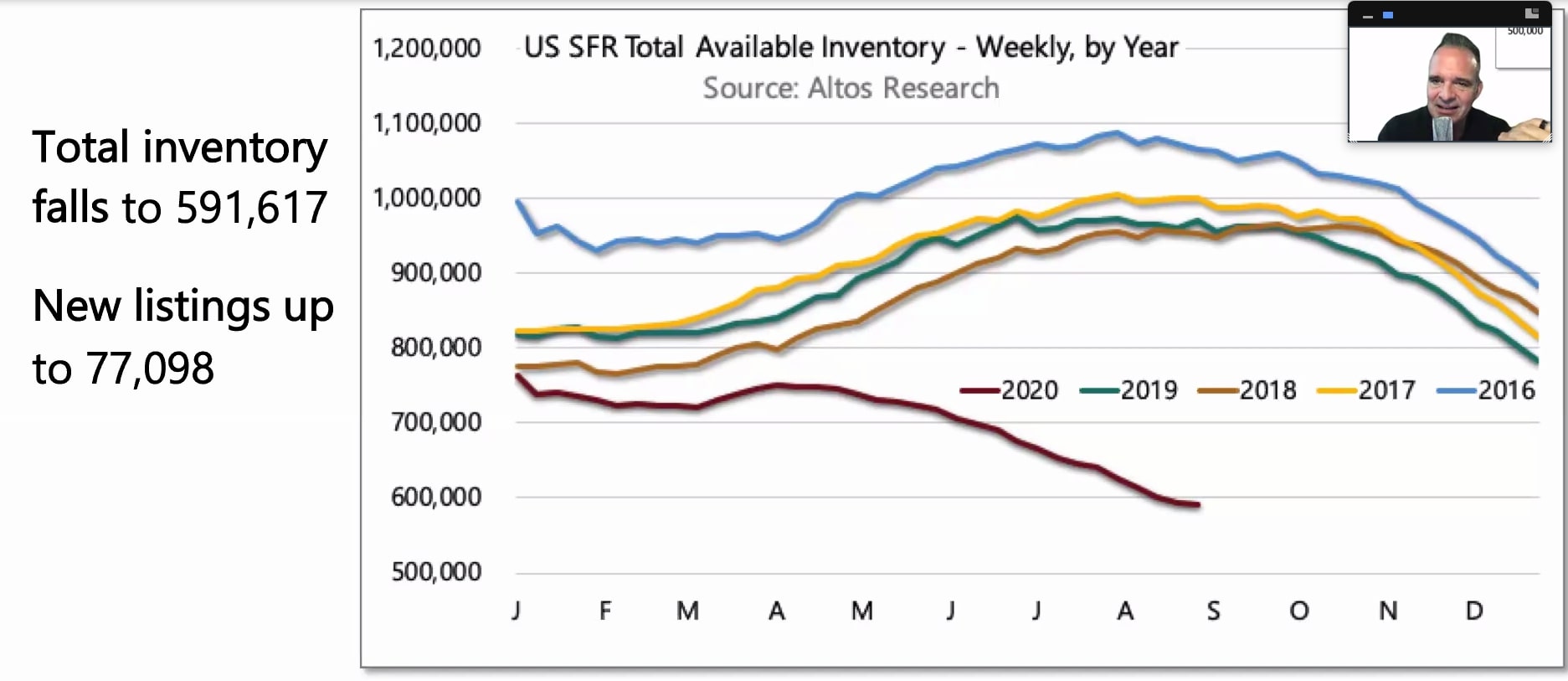

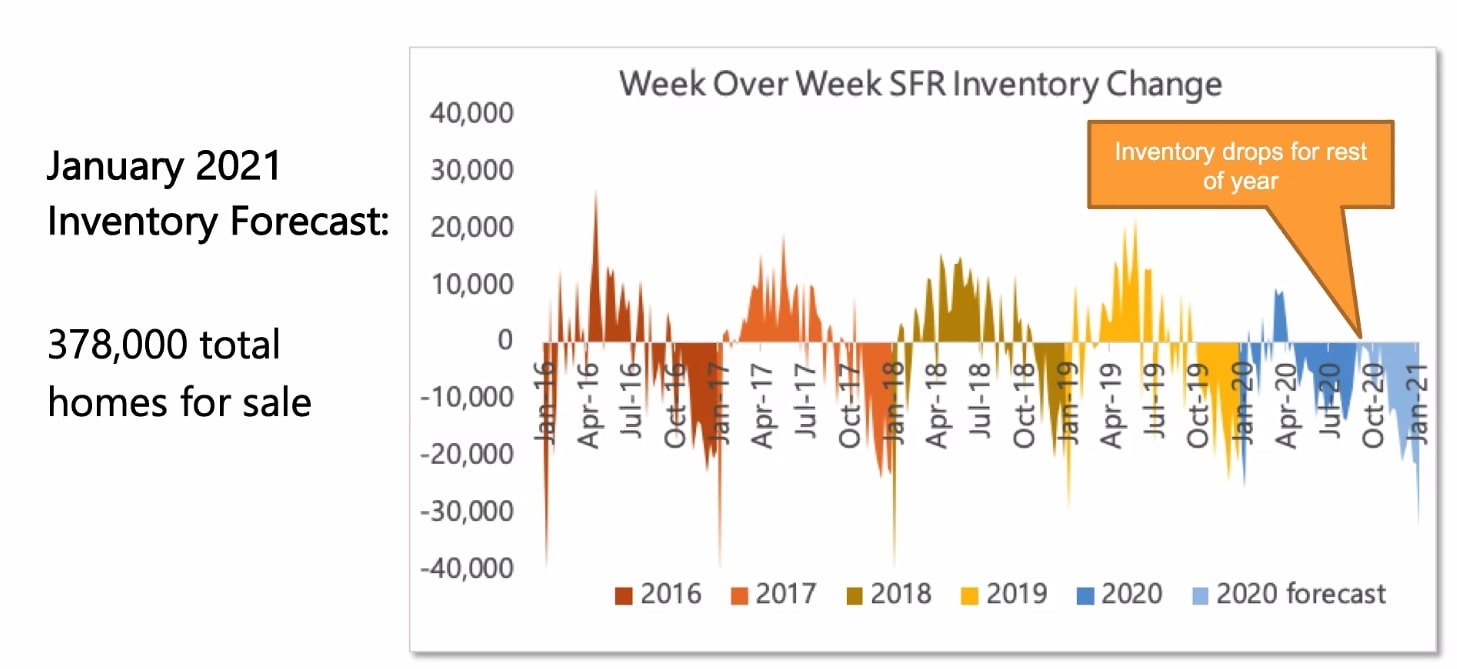

On the supply side, levels of for-sale properties remained extremely low, with active listings declining 18 percent in November 2020 from the prior month and 46.6 percent from a year ago. The unsold inventory index, in fact, reached the lowest level in over 16 years. The surge in Coronavirus cases since late October likely played a role in the bigger than-normal drop in active listings this year as many homeowners have been reluctant to put their house up on the market because of public health concerns.

As the imbalance between supply and demand continued to get worse, the California market has become ever more competitive. Properties have been flying off the shelf with a listing in November staying on the market typically for nine days before escrow opened, the shortest time-on-market since 2013. Homes for sale also received multiple offers more frequently, and the average number of offers per sale transaction reached their highest levels since 2013.According to the 2020 Annual Housing Market Survey released by the California Association of REALTORS® (C.A.R.),nearly two-thirds (59.2 percent) of homes sold in 2020 received multiple offers at an average of 4.8 offers per home. In2019, less than half (47.7 percent) of homes sold received multiple offers with an average of 3.9 offers on each property.

Fierce market competition appeared in the form of bidding war as well, as many properties were sold above asking price this year with their share to total sales up nearly 10 percent from 2019. Results from C.A.R.’s 2020 Annual Housing Market Survey show that over a third (35.5 percent) of home buyers paid more than what home sellers asked for this year, compared to a quarter (26.7 percent) in 2019. This year’s level, in fact, was the highest in seven years and was 16 percent higher than the long-run average.

The sales-price-to-list-price ratio in California also set a new record high. The ratio is calculated by dividing the final sales price of a property by its last list price and is expressed as a percentage. A sales-price-to-list-ratio with 100percent or above implies that the property sold for more than the list price, and a ratio below 100 percent indicates that the property was sold below the asking price. In November 2020, this indicator that reflects the negotiation power of buyers and sellers was at 100.5 percent and was the highest ever recorded in the past 30 years.

In a normal year, housing demand typically subsides and the market usually cools down during the holiday season.While the market is currently experiencing some seasonal slowdown, record low rates continue to keep buying interest above last year’s level and higher than the norm. With costs of borrowing expected to stay near historic lows and housing supply not likely to improve much in the next few months, the California market will likely remain heated and very competitive for the first half of 2021.