US home prices projected to grow ‘convincingly’ in 2024: Economist

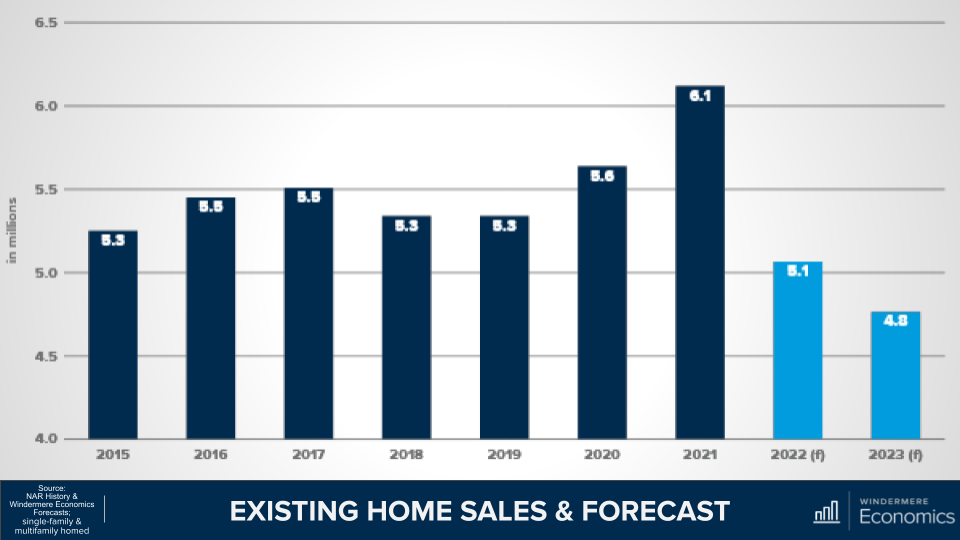

Existing-home sales are expected to tumble to a 12-year low by the end of 2023, but they won’t stay that way for long, Realtor.com Chief Economist Danielle Hale recently predicted

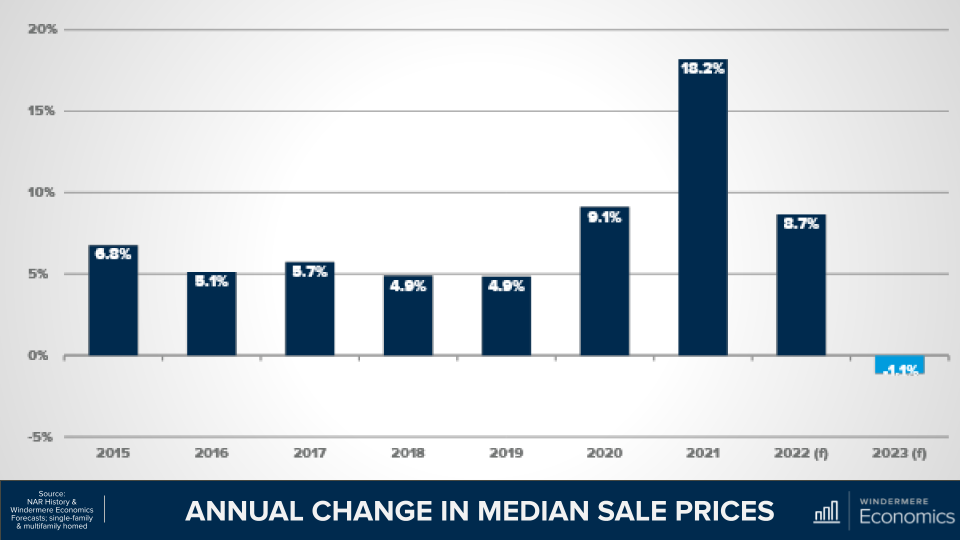

Home prices are set to fall in 2023, according to Realtor.com’s chief economist. But they won’t stay that way for long.

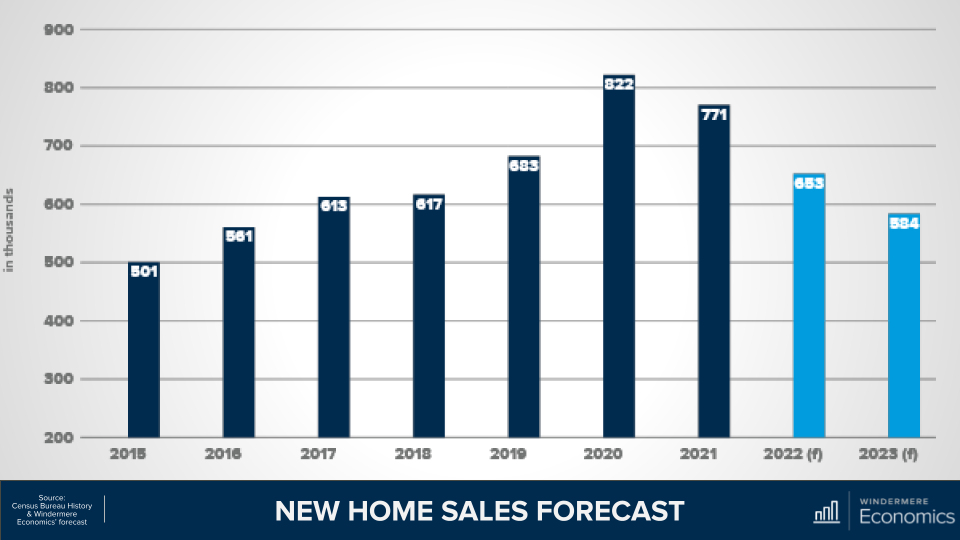

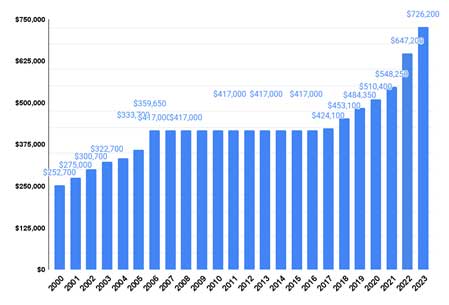

Prices are set to drop by less than 1 percent this year, Realtor.com’s Danielle Hale told Yahoo Finance Live on Wednesday. But prices are set to steadily climb next year, led by higher demand in new homes, she said.

“We’ll start to see home prices rebound more convincingly in 2024,” Hale told Yahoo Finance Live.

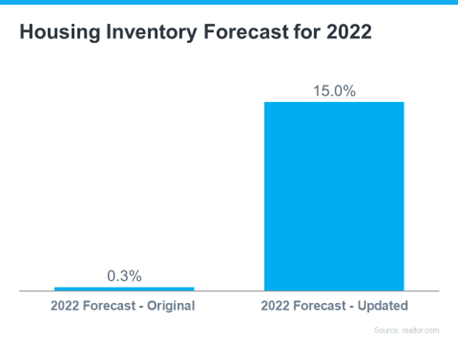

Realtor.com had originally predicted home prices would grow by 5.4 percent in 2023. It has since revised its outlook to forecast a 0.6 percent decline, according to a mid-year housing update the site shared in late June.

“It’s too soon to say that we’re in a housing recovery,” Hale told the outlet. “I think today’s price weakness is something we’re going to end up seeing for the next several months.”

Sales prices are down nationally, but that’s largely been driven by price declines in the Western region, Realtor.com said.

Realtor.com has said the nation likely saw a new low in sales volume in January. Prices are likely hitting a high point for the year before Hale expects them to fall throughout 2023.

Hale expects existing home sales to hit 4.2 million this year, the lowest total since 2012.

“There’s a strong seasonal pattern in the housing market. We tend to see the highest prices of the year in the summer and the lowest prices of the year in fall and winter,” Hale said. “That trend is happening.”

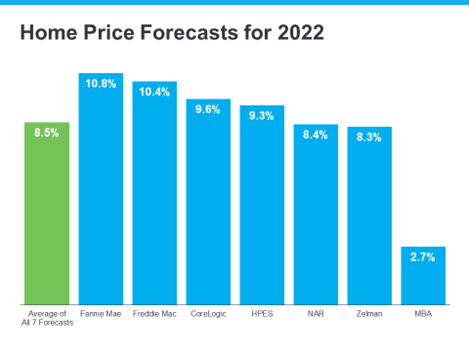

Hale didn’t quantify how much of a “convincing” rebound home prices would make next year, but her forecast on price declines is largely in line with other economists who responded to a Zillow poll earlier this year. The experts said prices would fall by just under 2 percent this year before growing at an annual rate of 3.5 percent each year through 2027.

Home prices spiked in 2021 and part of 2022, according to the Case-Shiller Index of home prices. The typical house sold for $436,800 in the first quarter, up 35 percent from the start of the pandemic in 2020.

Source: Taylor Anderson | Inman.com